Business Financing: Optimizing Products for SMBs

I served as the primary researcher for this exploratory study at BILL, where I set out to understand whether small and medium-sized businesses would adopt a new Banking-as-a-Service (BaaS) product offering FDIC insurance, competitive interest rates, and faster payment capabilities.

Through qualitative interviews and quantitative analysis, I identified core barriers to adoption — including switching friction, brand trust, and low perceived differentiation. These findings informed a strategic shift in product positioning and helped BILL define BaaS as part of its broader financial ecosystem.

Jump to:

BILL Overview | Problem Statement | Methods | Insights | Recommendations | Impact | Lessons Learned

What Does BILL Do?

BILL is a financial automation platform that helps small and midsize businesses (SMBs) manage their payables, receivables, and overall cash flow. By streamlining core financial operations, BILL enables businesses to save time, stay organized, and make smarter financial decisions.

Spearheading early research into BILL’s BaaS product, I explored whether SMBs would find value in a banking solution offering FDIC protection, competitive interest rates, and faster payments. The work revealed major switching barriers and trust concerns, which shaped early product direction and clarified how BaaS fits into BILL’s broader financial ecosystem

Why Was This Research Needed?

As BILL explored opportunities to expand into financial services, early signs showed that customers were hesitant to adopt Banking-as-a-Service (BaaS) as their primary financial account. Most felt satisfied with their current banks and didn’t see a clear reason to switch—especially when existing solutions already offered competitive features, FDIC protection, and established trust.

To reduce uncertainty and guide product strategy, the team needed to understand how customers perceived the value of BaaS, what role it could realistically play in their financial ecosystem, and whether the product aligned with their everyday needs.

To explore this further, we focused on questions like:

What would motivate customers to adopt a new financial account?

How do they assess trust and credibility in banking partners?

What existing behaviors or mental models could block adoption?

How does BaaS fit into—or conflict with—their current workflows?

How I Approached the Research?

To explore how customers perceived the value of BaaS, I followed a mixed-method approach to surface behaviors, validate assumptions, and shape product thinking.

Stakeholder alignment

I partnered with BILL’s credit and data teams to outline our target customer group based on borrowing needs, helping ensure the research would reflect the right users from the outset.

Interviews

I led interviews with 6 SMBs to understand how they manage money across multiple accounts, what factors drive trust in financial services, and their openness to switching from their current bank setup.

Surveys

Based on the interview findings, I launched a quantitative survey with 100 participants to measure broader sentiment toward new financial products, barriers to adoption, and preferences for features like FDIC protection, APY, and faster payments.

Collaboration

This work was woven into product planning alongside design, engineering, and go-to-market leads—ensuring results could be immediately applied to roadmap prioritization and messaging.

Story in the Numbers

What Needed to Be Done Next?

Based on the feedback, we proposed early-stage refinements to increase relevance and build trust in the Banking-as-a-Service (BaaS) product:

Position the product as a secondary account

Most customers were satisfied with their current banks and hesitant to switch. We recommended reframing BaaS as a complementary account — ideal for holding surplus funds or testing new features without high commitment.

Surface credibility signals

Participants emphasized the importance of stability and brand recognition. We recommended highlighting institutional partnerships, available support, and banking safeguards to strengthen trust.

Tailor messaging by customer size

Insights showed that smaller SMBs were more open to experimentation. We proposed segmenting outreach and onboarding strategies to better align with each group's needs and level of comfort.

Clarify naming and value framing

Several participants were unsure what the product actually offered. We suggested exploring clearer, benefit-driven naming and messaging to establish credibility and reduce confusion.

Reinforce must-have expectations like FDIC protection and APY

Participants expected any financial account to include FDIC insurance and competitive interest rates. We advised clearly surfacing these features to avoid being dismissed outright during evaluation.

How Did This Shape the Product?

The research helped move BaaS from a one-size-fits-all product concept to a more targeted offering with clearer use cases and messaging.

Here’s how it shaped product direction and internal planning:

The team began exploring niche, high-value use cases — like cash reserves or payout routing — after realizing most SMBs weren’t looking to replace their primary bank.

We refined customer segmentation and messaging, tailoring positioning to reflect differing levels of trust, adoption readiness, and financial behavior across SMB tiers.

The work prompted a strategic shift away from “banking replacement” thinking and toward complementary, low-friction account behaviors — helping the team rethink product role and scope.

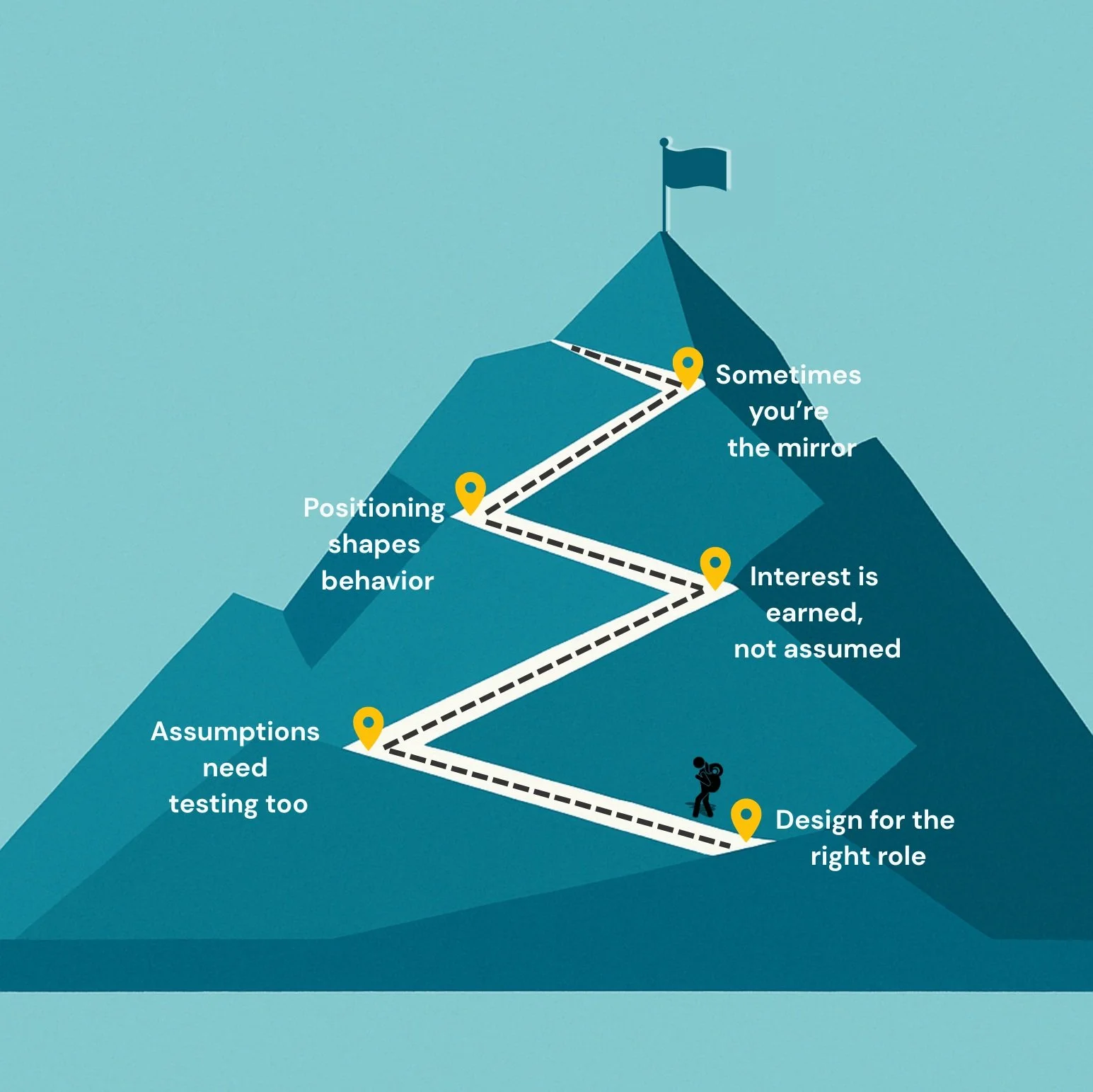

What I Learned?

Not every product needs to replace something — sometimes it just needs to fit in.

Trying to position BaaS as a bank replacement missed what users actually needed. This project reminded me that strategic fit matters just as much as functionality.

Assumptions are easy to make — and even easier to miss.

Internally, we thought the product’s value would be obvious. But users needed more than features — they needed a reason to care. This project taught me how important it is to test not just usability, but clarity and relevance from the very start.

Disengagement is a data point.

When users skim, stall, or check out, it’s rarely about content alone. This study taught me to notice subtle forms of disengagement — they often reveal more than critique.

Positioning is part of product design.

Research wasn’t just about usability or interest — it was about defining the product’s role in people’s financial lives. This helped me see how early framing shapes not just adoption, but intent.

It’s not easy to deliver answers no one hoped for.

Presenting research that contradicts assumptions is uncomfortable — especially when timelines and roadmaps are already in motion. But this experience reminded me that surfacing hard truths early is what gives teams the power to adjust, not just react.